Welcome to the latest edition of MobileTime, a blog about the issues affecting mobile time tracking and the construction industry in general. Our goal for this blog is to provide useful, helpful information presented in a concise format to our customers and all others who might benefit. Today’s article looks at the national infrastructure bank legislation currently proposed in Congress.

Now that the debt crisis issue is finally over with (at least for a while), our nation’s leaders, both Democratic and Republican, have turned their attention to the more pressing problem of creating jobs for this very tepid economy. The Administration has hinted that they would like to make a National Infrastructure Bank a big part of their jobs package. How will this work? What will be the source of funding? And finally, who will be the customers of a National Infrastructure Bank?

Currently, there are 2 proposals in Congress.

In the Senate, John Kerry (D- Mass.) introduced a bill in March of 2011 to create an independent, nonprofit bank that would leverage private investment into infrastructure projects. The bill has 8 co-sponsors from both parties. The bill would require $10 billion in start-up money from the government to get the first loans going and cover administrative costs. The bank would be a wholly-owned government corporation, run by a chief executive officer and managed by a board of directors, independent of any federal agency and self-sustaining after the initial expense. Public-private partnerships, corporations and state and local governments would be eligible for the loans. Projects to be considered under this bill would have to have a cost of at least $100 million ($25 million for rural infrastructure projects). Project selection would be based on an analysis of costs, benefits, and loan repayment sources such as tolls or fees. Supporters of this bill think the revenue stream for payback of the loans will allow the projects to stand on their own, and by doing so, be good enough to attract private-sector funding.

Rep. Rosa DeLauro (D-CT) has sponsored a bill in the House that would create a wholly-owned government corporation named the National Infrastructure Development Bank with $25 billion in initial capital. It would also be set-up very similarly to the Senate version with a chief executive officer and a board of directors. Unlike Kerry’s bill, there are no specific size limits on projects which will focuse on transportation, environmental, energy, and telecommunications projects.

The concept of an infrastructure bank is supported by most Democrats and by two parties who are usually on opposite ends of the negotiating table – the U. S. Chamber of Commerce and the AFL-CIO. There are many others who question the effectiveness of this device to quickly create a large number of jobs in a short period arguing that most projects are not “shovel-ready”. Republicans are solidly against the idea with Speaker of the House John Boehner calling it “more of the same failed ‘stimulus’ spending”.

The likelihood of passage of such legislation will probably come down to a few main factors:

- Whether Congress has a change of heart and determines that job creation is a more important factor than reducing the deficit,

- The perceived ability of such a bank to approve projects that will quickly provide a large number of jobs, mostly in construction where they are desperately needed,

- The perceived ability of the individual projects to create revenue streams sufficient to pay the debt

Rep. Rosa DeLauro noted that China invests 9 percent of its GDP in infrastructure, while India invests 5 percent. The figure for the United States, she said, is less than 2 percent.

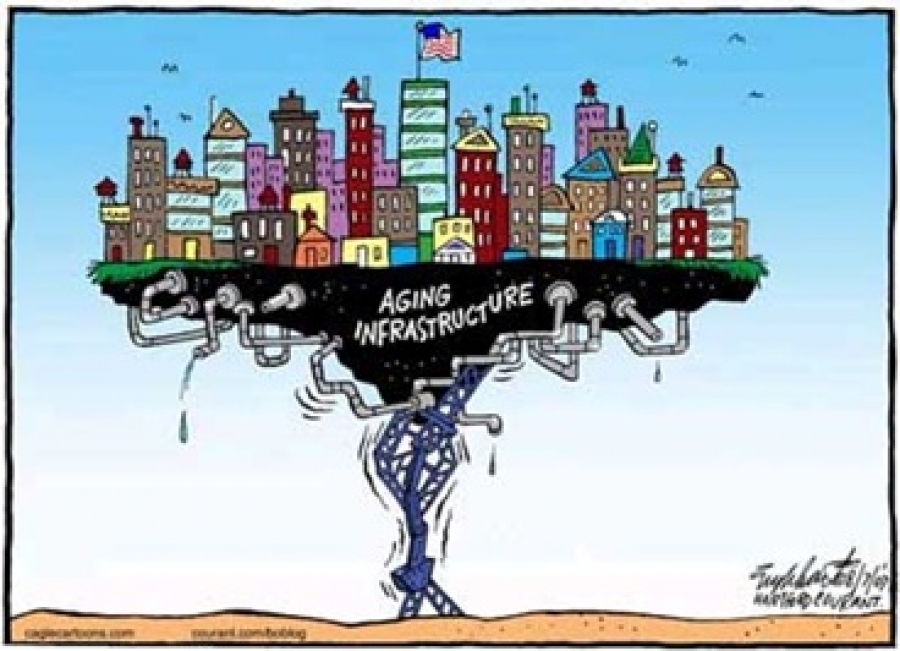

Treasury Secretary Timothy Geithner said in February that a national infrastructure bank would focus on three specific industries – construction, manufacturing, and retail trade. There seems to be a pretty wide consensus that our nation’s infrastructure is in disrepair, but given the current political climate, the chances for passage of the aforementioned legislation appear very slim.